Yes, it is true you are liable for the customs duty fee in India whenever you import any sort of products or goods.

We will mention step by step guide that you need to know about custom duty fee in India.

How to avoid custom duty fees in India?

Step 1– If you are getting the product through any company as a sample piece of something then you can ask the company to cover up the custom duty fee.

Step 2– If you have ordered the product from any independent supplier or retailer then ask him to cover up half of the customs duty fee or provide you with the discount.

Step 3– If any of your friends are sending you the gift then ask him to forward it through any postal service or through any of his known member who is visiting at your place.

Step 4– If you are buying from any E-commerce marketplace other than the well-known ones then ask them to arrange through any of the shipping services that take care of the customs fees on their own.

Note–

You are only applicable to pay the customs duty fee if your product amount exceeds above Rs 50,000.

Other than this you can also hire any third party shipping company to get your product shipped at your place because they import-export the number of products in bulk, so it’s easy for them to take care of the customs duty fee in India in their own way.

How to calculate custom duty import fee?

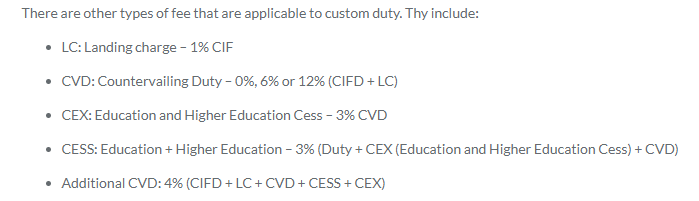

Custom duty rates?

How to pay custom duty fee?

Through Ice Gate portal – Click here to pay

Useful resource:

India E-Commerce – Customs & duties when shipping international – Read more