We all know the growth of India’s economy which is rising like never before and ranked 5th in the list in terms of GDP following by the other asian countries like China | Indonesia and many more.

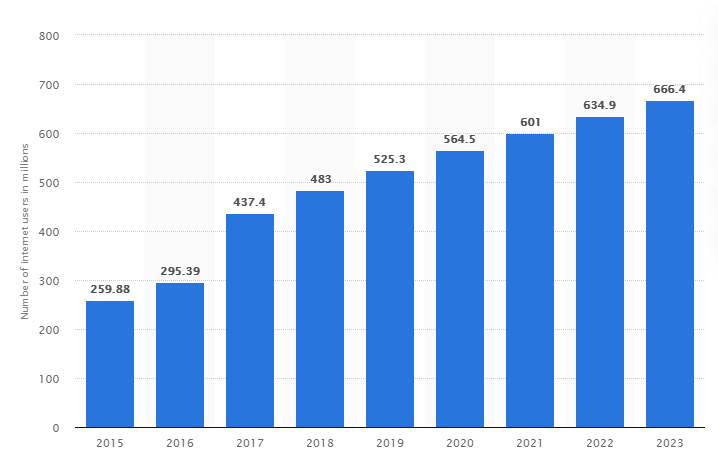

The main reason behind this growth is the rise of E-commerce industry with the worldwide investments that are coming in India because of its large population and internet penetration.

Along with it the rise of the fintech industry(payment gateway) is increasing and the people of India are adopting the digital India initiatives initiated under Mr. Narendra Modi’s leadership.

Under his leadership, the E-commerce policy is modified to give the most benefits to entrepreneurs | businesses and by his skills, he managed to bring trillions of foreign investment in India.

It’s a good opportunity for people around the world to get their Offshore company registration in India with a bank account and basically it is beneficial for Entrepreneurs and Businesses who want to expand their business overseas.

Benefits of Offshore Company & Banking

- Protect assets

- Legal protection

- Tax benefits

- Free regulations

- Legal lawsuit protection

- Financial privacy

- Banking structure

- Expand overseas

Offshore company registration in India

If you want to open up a corporation in India you need to meet out with the below-mentioned requirements:

1- Two Director (if you want to open a private company in India so as per Companies Act, 2013, there must be a minimum of two directors and out of 1 should be an Indian citizen)

2-Official Address (to open a company in India you must have a permanent place in India (it may be rented or own)

3- Two shareholders (if you have a private company which is limited by shares), as per companies Act, 2013, you must have a minimum of two shareholders(1 should be an Indian citizen) which can be increased up to 200 shareholders

Documents needed from Directors & Shareholders

- Identity Proof

Permanent Account Number (PAN) Card

Aadhaar Card / Passport / Driving License / Voter Identity Card - Address Proof

Telephone Bill / Mobile Bill

Electricity Bill / Water Bill - Passport size photographs

Note: All the Copies of documents must be self-attested by the applicant. Telephone Bill / Mobile Bill/Electricity Bill / Bank Account Statement must be in the name of the applicant and should not be older than 2 months.

If the documents are not in English then it should be translated into English.

Documents to be signed by the directors

1) Consent to act as Director: Form DIR-2

2) Details for DIN

3) Registered Office Address

4) No-objection letter from the Owner of address

5) Address Proof – In the name of the Owner

6) Electricity Bill, Telephone Bill (Fixed Line Only), Gas Bill or Water Bill (Not older than 2 months);- To be signed by the owner of premises or tax paid receipt or copy of registered sales deed- To be signed by the Shared Office Service provider.

Open up an Offshore bank account in India: As soon as you will get your company incorporated in India and get the complete set of documents, it would take less than a week to open up your offshore bank account.

Useful resources:

Digital India Report 2020 By DATAREPORTAL