Updated: 28/06/2024

India’s readymade garments along with other textiles are famous Indian products around the world and especially in the United States of America.

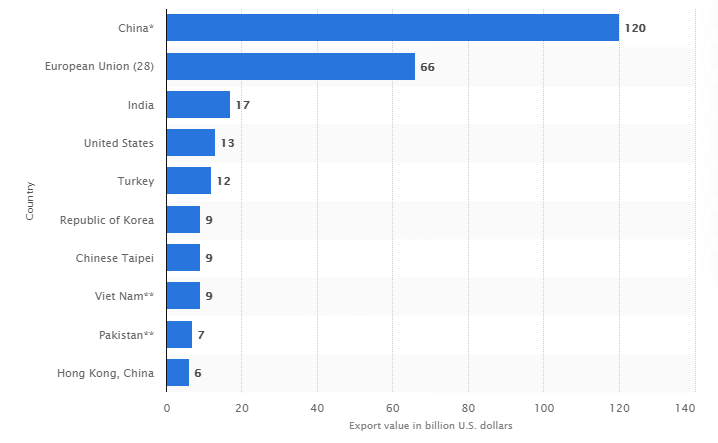

India is the 3rd largest textile-exporting country in the world after China and European Union countries.

Bhartiya artist’s unique designs and artwork are world-famous because of the authenticity and love through which they made them.

Cotton and Silk along with denim are the few Indian products that have a high demand in the USA and other countries in Europe.

Export revenue through Indian readymade garments reached $42 billion by the year 2024.

Indian textile industry employs 45 million people and contributes 3% to the country’s GDP, which is also a total of 12% of export revenue.

Import duty on readymade garments in USA from India

It can be defined through the steps below that anyone can follow to find out the import duty rates for any products selling from India to the USA or from any other part of the world.

Step 1: Go to HTS – Harmonized Tariff System

Step 2: Go to Chapter XI or 11

Step 3: Read Chapter 61

Step 4: Find through Subheading 6109.10.00

We understand that many of the sellers or exporters get confused to find out the right import duty on readymade garments in USA from India.

So, we have mentioned the import duty for Indian garments and apparel in the below-mentioned image.

The government of India has also increased the Merchandise Export From India Scheme up to 6%. AEPC – Apparel Export Promotion Council supports the apparel industry by connecting the export-sourcing destination countries through several initiatives & schemes.

If you need to know the complete scenario about the custom import duty rates from India to USA then do checkout our below-mentioned articles.

Useful resources

Custom Import duty rates in USA